Our Process

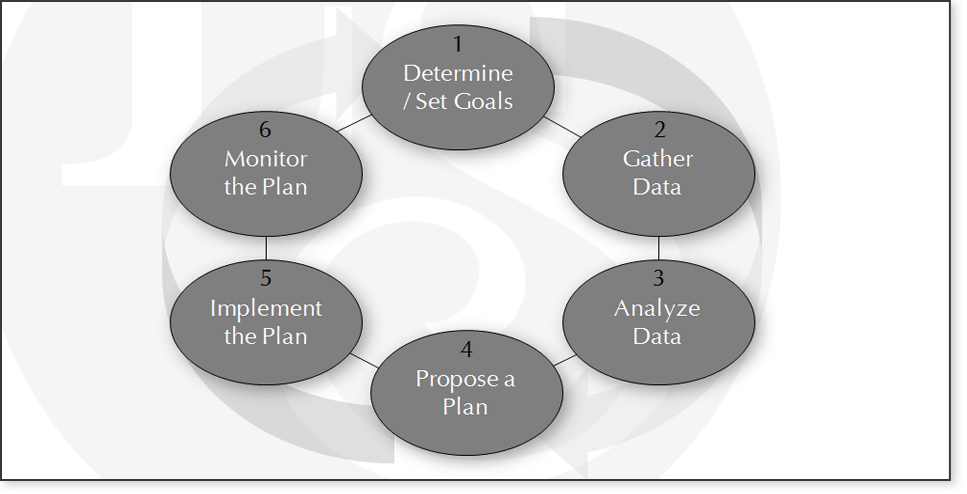

The financial planning process is the backbone of what our advisors do at Langdon Shaw. The six step process, illustrated below, is a continuous process that helps us understand your needs and create a plan to help achieve your goals. Communication and understanding are critical in the financial planning process. Our advisors are here to consult, educate and help you make the best financial decisions that you can.

1. Determine/Set Goals

In order to get where you want to go, you first need to know where you’re going. It is important to set realistic and achievable goals. The first thing our advisors will help you do is define those goals. This will provide a base for formulating a plan that will work for you.

2. Gather Data

Formulating a plan for your future is much more effective when we know where you are starting. Our advisors will discuss your current financial situation and gather any necessary information. It is also important for them to get a good understanding about your tolerance for investment related risk.

3. Analyze Data

Once the necessary data has been gathered, our team of advisors will spend time analyzing your current situation and will formulate a plan that is tailored to your needs.

4. Propose a Plan

The next meeting will involve a proposal of a financial plan to help you meet your goals. Our advisors will talk through the plan and recommendations so that you can make informed decisions. They want to make sure the plan works for you. If necessary, adjustments can be made at this time.

5. Implement the Plan

Once the plan is set it is time to put it in place. There can be many pieces to a comprehensive financial plan, sometimes requiring the involvement of additional parties. Our advisors will coordinate the implementation and help see that everything is done properly.

6. Monitor the Plan

The work doesn’t stop once your plan is in place. Our advisors will continue to monitor the plan and your investments to help ensure that everything continues to meet your needs.